Virtual Cfo In Vancouver Fundamentals Explained

Wiki Article

The Only Guide for Vancouver Tax Accounting Company

Table of ContentsFacts About Small Business Accountant Vancouver RevealedIndicators on Small Business Accounting Service In Vancouver You Should KnowWhat Does Small Business Accounting Service In Vancouver Mean?The Ultimate Guide To Vancouver Accounting Firm

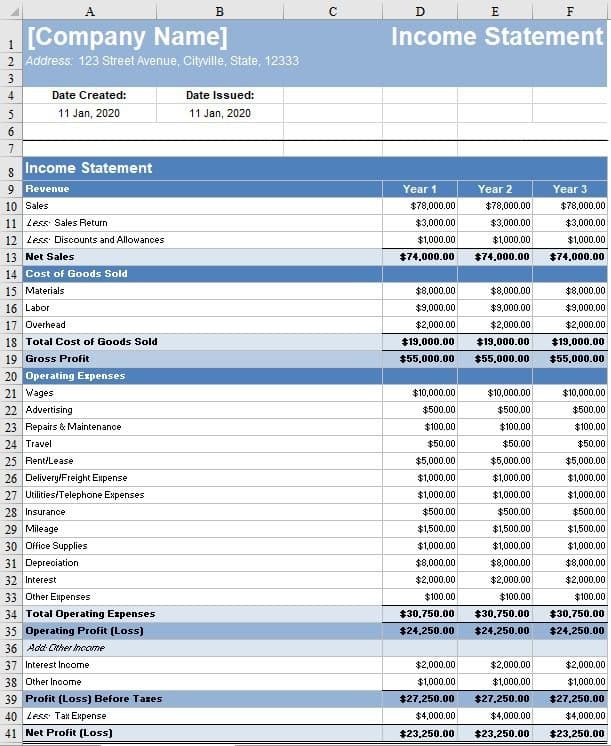

That takes place for every solitary transaction you make throughout a provided bookkeeping period. Functioning with an accountant can aid you hash out those information to make the accountancy procedure job for you.

You make changes to the journal access to make sure all the numbers include up. That might consist of making adjustments to numbers or taking care of built up products, which are expenses or income that you incur however do not yet pay for.

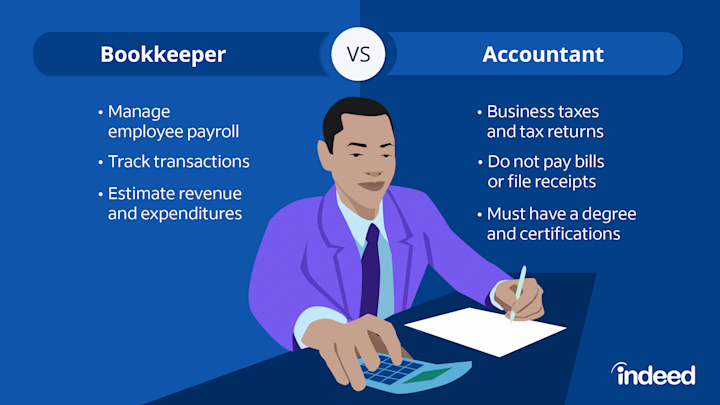

For aspiring financing specialists, the inquiry of accountant vs. accountant prevails. Accountants as well as accountants take the same foundational bookkeeping courses. However, accountants go on for more training and education and learning, which causes differences in their duties, revenues expectations and career growth. This guide will certainly offer an in-depth failure of what separates bookkeepers from accountants, so you can comprehend which audit duty is the most effective fit for your job desires currently as well as in the future.

About Vancouver Accounting Firm

An accountant constructs on the information provided to them by the accountant. Generally, they'll: Review economic declarations prepared by a bookkeeper. The records reported by the accountant will certainly determine the accounting professional's suggestions to leadership, and ultimately, the health of the business overall.e., government companies, colleges, medical facilities, etc). An educated and competent bookkeeper with years of experience and first-hand knowledge of bookkeeping applications ismost likelymore certified to run guides for your business than a current accountancy major grad. Maintain this in mind when filtering system applications; attempt not to judge applicants based on their education and learning alone.

Organization projections and fads are based on your historical financial data. The monetary data is most trustworthy and exact when supplied with a durable and also organized accounting process.

More About Vancouver Accounting Firm

An accountant's job is to maintain total documents of all cash that has actually come right into and also gone out of the business. Their documents make it possible for accounting professionals to do their work.Typically, an accountant or proprietor looks after a bookkeeper's work. An accountant is not an accountant, neither must they be considered an accountant. Bookkeepers document monetary transactions, post debits as well as debts, develop billings, take care of payroll and also maintain and also balance the publications. Bookkeepers aren't called for to be certified have a peek at this site to manage guides for their clients or company however licensing is offered.

Three primary elements influence your More Bonuses costs: the services you want, the experience you require and your neighborhood market. The accounting services your service needs as well as the amount of time it takes once a week or month-to-month to finish them influence just how much it sets you back to work with a bookkeeper. If you require someone ahead to the office as soon as a month to fix up the publications, it will set you back less than if you need to work with someone full-time to handle your everyday procedures.

Based on that computation, make a decision if you require to hire somebody permanent, part-time or on a project basis. If you have intricate books or are bringing in a great deal of sales, hire a certified or accredited bookkeeper. A knowledgeable accountant can offer you comfort and also confidence that your financial resources remain in excellent hands however they will additionally cost you extra.

Rumored Buzz on Vancouver Tax Accounting Company

If you live in a high-wage state like New York, you'll pay more for an accountant than you would certainly in South Dakota. There are a number of benefits to working with a bookkeeper to submit and document your company's economic records.

Then, they may pursue added certifications, such as the certified public accountant. Accountants might likewise hold the setting of bookkeeper. If your accounting professional does your accounting, you may be paying more than you should for this solution as you would typically pay more per hr for an accountant than a bookkeeper.

To complete the program, accountants must discover this have 4 years of relevant job experience. The point here is that working with a CFA implies bringing extremely sophisticated bookkeeping expertise to your business.

To get this qualification, an accountant needs to pass the needed examinations as well as have 2 years of professional experience. You might hire a CIA if you desire a much more customized emphasis on financial risk evaluation and safety and security tracking processes.

Report this wiki page